Kambale Graphite Project

Castle’s Kambale graphite project just keeps delivering:

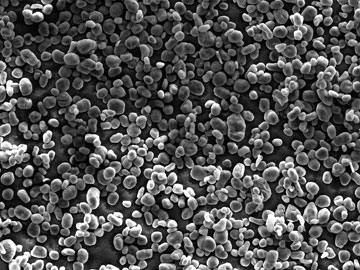

- March 2024: Successful Battery Anode Tests – Electrochemical test work confirms Kambale natural flake graphite is suitable for use in manufacture of lithium-ion and other battery formats, with a range of key charging, stability and other performance benchmarks achieved.

- February 2024: Outstanding purification results showing purification of 99.97% TGC which exceeds industry benchmark for use in EV battery anode manufacture and confirming no impurities of concern. Prior micronisation and spheronisation processes also successfully completed.

Castle Managing Director, Stephen Stone commented:

“We are extremely pleased that recently completed electrochemical tests have confirmed Kambale graphite’s status as a very attractive base for the manufacture of lithium-ion electric vehicle battery anodes and a range of other high-value primary and secondary applications.

Purified Kambale graphite met a range of chargeability, stability and other critical performance benchmarks during tests undertaken in an accredited facility in Germany.

In rapid succession Castle has defined a 22.4 million tonne resource grading a very respectable 8.6% TGC and shown it can be upgraded into a valuable 95% LOI graphite concentrate using a conventional flowsheet.

In February this year Castle reported that it had successfully purified this concentrate to an above industry specification of 99.97% LOI, again using a conventional process.

This is all happening at a time when the world needs considerably more fine natural flake graphite to underpin forecasts of very strong growth in the uptake of electric vehicles.

Recent third party offtake deals between non-Chinese upstream producers of primary natural graphite concentrate and downstream manufacturers of natural graphite conductive additives for anodes, cathodes and other secondary battery chemistries are evidence of a paradigm shift in markets away from a high dependency on China supply.

The USA and EU have established billion dollar initiatives to help establish independent supply chains of critical minerals such as graphite. Kambale would therefore be ideally timed and well placed to service both existing and also these new emerging markets.

Recent meetings with the Ghana government confirmed its strong support for any development at Kambale as part of a broader ambition it has to establish West Africa’s first critical minerals hub.

Castle’s view remains that the graphite market is fundamentally very robust and graphite is definitely a commodity to watch this year and into the longer term.”

Mineral Resource Estimate (JORC 2012)

| Classification | Tonnes (kt) | Contained TGC (kt) | TGC (%) |

|---|---|---|---|

| Indicated | 9,556 | 843 | 8.8% |

| Inferred | 12,872 | 1,096 | 8.5% |

| Total | 22,438 | 1,939 | 8.6% |

|

5% TGC Cut-Off. TGC = Total Graphitic Carbon For full details, see ASX release dated 23 October 2023 |

|||

Castle Managing Director, Stephen Stone commented:

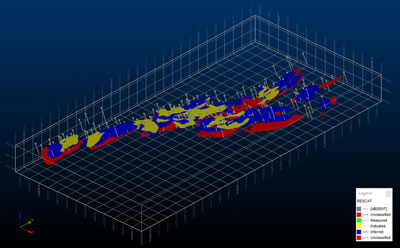

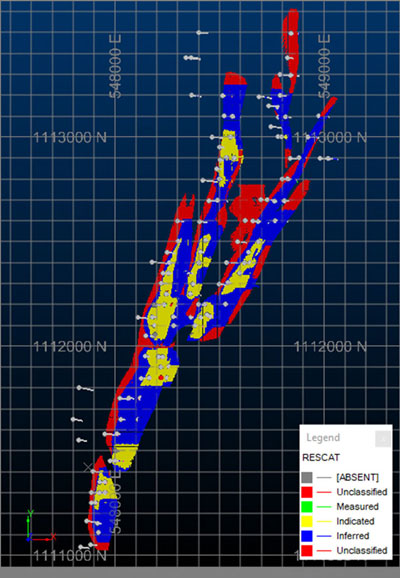

“We are delighted to deliver for the fast-emerging Kambale Graphite Project a 38% increase in contained graphite and can now boast a Mineral Resource Estimate of 22.4 million tonnes grading 8.6% TGC containing 1.94 million tonnes of graphite. Forty-three percent of the MRE is in the higher confidence Indicated Resource category.

The MRE increase provides a very solid platform upon which to advance our development ambitions, especially now that Castle has demonstrated in test work that a fine flake graphite concentrate of commercial specifications can be produced using a conventional flotation process. This is the primary material used in the manufacture of lithium-ion battery anodes.

This all comes just as China this week has introduced a surprise ban on natural and synthetic graphite exports to protect its battery and car manufacturing industries. This will immediately intensify the multi-billion dollar rush by the USA, EU and other non-China EV manufacturing nations to secure other sources of graphite, battery anodes and EV batteries which they are presently almost totally reliant on China for.

The accelerating take-up of EVs alone is driving an enormous increase in demand for graphite for use in lithium-ion batteries for EVs, power storage units and other chargeable consumer devices.

Each EV contains between 30kg and 60kg of battery grade graphite where every kg of that is derived from at least 3kg of natural flake concentrate.

With another 100 million light EVs forecast to be on the road by 2030, it’s no surprise that forecasters are predicting a natural graphite concentrate supply deficit as current and proposed supply is wholly inadequate.

Castle continues to fast-track and de-risk its Kambale Graphite Project and has just kicked off a specialist evaluation in Germany of the concentrate to confirm its suitability for the manufacture of lithium-ion batteries.

Mining and metallurgical engineering groups will be appointed shortly to assess the technical and commercial merits of establishing on-site a commercial-scale mining and processing facility.

With good access to two international ports in Ghana that can service the USA and EU markets, Kambale has a strategic importance as a still uncommitted resource. The Project will also use mainly hydro-generated “green-grid” power. With Ghana recognised as a safe, stable and established mining jurisdiction, this all bodes well for the Project’s future.”

Project Background

The Kambale graphite deposit was identified in the 1960s by Russian geologists prospecting for manganese. They undertook a program of trenching and drilled 25 holes to a maximum depth of 25m.

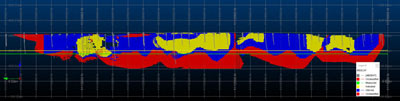

The mineralisation consists of north-east trending, sub-parallel zones of meta-sediment which is host to the graphitic schists. The Lower Proterozoic Birimian (~2.2Ma) meta sedimentary rocks, namely phyllites, and quartz–biotite schists, generally trend north-easterly and dip between 50o and 75o to the north west. The schists are hosted mainly in granodiorite.

The genesis of the flake graphite in Kambale is believed to be the result of high-grade metamorphism (amphibolite-granulite facies) which has converted trapped amorphous carbon into the characteristic fine crystalline layers.

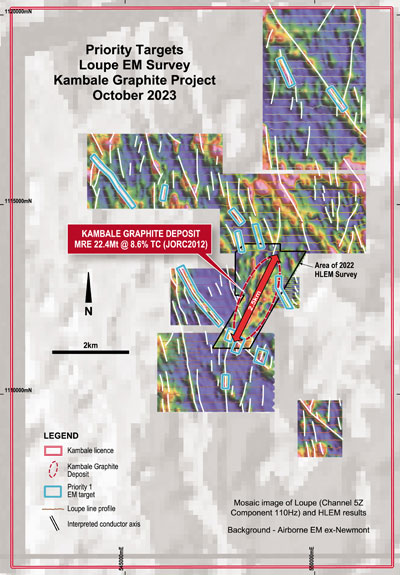

Castle reviewed the historical work and a wide-spaced, regional-scale electromagnetic survey dataset inherited from previous licence holder, Newmont Limited. This work outlined a roughly elongate, northsouth orientated, ~10km-long region considered prospective for graphitic schist horizons which may host multiple lenses of graphite mineralisation, similar to what is already outlined from drilling and trenching at Kambale. These lenses or horizons can vary in length and be up to 50m wide, creating substantial deposits of graphite.

Encouraged by firm graphite prices in 2012, Castle undertook three consecutive phases of drilling comprising RAB (251 holes, 5,621m), aircore (89 holes, 2,808m) and reverse circulation (3 holes, 303m). Mapping noted occasional outcrops of manganese and graphitic schist as well as graphite in termite mounds.

In 2012 Castle undertook a very limited program of bench-scale test work on RC chips. Thereafter, little work was undertaken until the more recent improvement in graphite prices prompted a re-evaluation of the Project in early 2021.

In September 2021 Castle’s new management team reported that preliminary test work on sub-optimal near-surface, weathered graphitic schists yielded very encouraging fine flake graphite concentrate grades of up to 96.4% and recoveries of 88%. A conventional multiple grind and flotation concentration flowsheet was used. Three excavated and composited samples provided for the test work graded 12.56%, 16.09% and 17.16% total carbon.

In March 2022, a ground electromagnetic (HLEM) survey demonstrated a strong correlation between drill confirmed graphite mineralisation and zones of high conductivity. Several high conductivity zones extending well outside of the existing Inferred Resource boundary were highlighted indicating the possibility of extensions of the known graphitic schists into sparsely or undrilled areas.

In late 2022/early 2023 52-hole 5,353m RC program was undertaken to test the interpreted steep dipping, shallow conductive plates from the EM survey. The results confirmed that the majority of the plates where due to graphite mineralisation and that the graphite continued to depths of at least 100m and likely beyond. In April 2023 a maiden MRE (JORC2012) exceeding 1.4Mt contained graphite was announced (ASX release dated 12 April 2023).

During the April 2023 MRE work, a large portion of mineralisation was unclassified and not included in the MRE, so from May to September 2023, infill drilling was completed confirming continuity and grade. On 23 October 2023 the Company announced the Maiden JORC Code (2012) MRE had increased by 38% to 22.4Mt at 8.6% TGC containing 1.9Mt of graphite (ASX release dated 23 October 2023).

During 2023 Graphite concentrate sample successfully produced during Perth test work, with bulk sample now in Germany undergoing evaluation for its use in lithium-ion batteries.

Logistics and infrastructure

The Project is located 6km west of the Upper West region capital of Wa which is 400km north, via good sealed roads, of Kumasi. From Kumasi it is approximately 240km south east by rail or road to the international port of Tema, 30km west of the capital Accra, which provides direct access to global export markets. An alternative international port at Sekondi–Takoradi is located approximately 230km west of Accra.

The Wa region has an excellent infrastructure comprising a commercial airport with daily flights, reliable grid power supplied partly by a hydroelectric dam at Bui, river (Black Volta River) and artesian water and many other useful services.

Ghana

Ghana has a well-established mining industry including several Tier-1 mining operations. It is now Africa’s largest gold producer and the World’s sixth largest and accordingly has a well-trained and very capable workforce supported by an excellent mining services and supply sector. It is a safe and politically stable jurisdiction based on the Westminster system and has a workable Mining Act and fiscal regime.

Social licence

Castle management has spent over 14 years successfully operating in Ghana and in particular its Upper West region. The Company has established an excellent reputation for its pro-active commitment to community engagement, local employment and training, the promotion of youth and women’s development initiatives, maintaining the highest environmental operating standards and overall operating ethically and sustainably whilst carefully managing community expectations.

Prior to embarking on any specific exploration program the Company’s Ghanaian team conducts comprehensive discussions with all stakeholders to fully inform them as to the Company’s activities and to identify sites of cultural, religious, social and economic sensitivity and to appropriately mitigate any matters of concern. Compensation for access and any disruptions caused is provided at a minimum as per Ghana Mining Act guidelines. All site disturbances are rehabilitated immediately after use and in close consultation with landowners.

Graphite market

The graphite market is diverse across industrial, metallurgical, chemical and specialised areas with each sector requiring graphite concentrates with specific qualities. Deposit type, size and geometry, flake size, flake shape, grade, impurities, capital and operating costs, ability to be refined, proximity to specific markets, supply logistics, jurisdiction, fiscal regime and many other factors all combine to determine the commercial viability of a particular deposit.

The current medium to long term outlook for the broader graphite concentrates market is one of escalating demand and a looming supply deficit driven in particular by its use in the fast-growing EV battery and stationary power storage sectors. At present, there is no viable substitute for graphite.

There is an increasing proportion of natural graphite, over high CO₂ generating synthetic graphite, being used in battery anode manufacture which also requires a fine flake graphite as the primary raw material. Hence, prices for fine flake graphite concentrates have shown a steady upwards trend in the past year.

The reader is directed to numerous recent publications, conference proceedings, market research papers and corporate websites of companies engaged in graphite exploration, project development or production for informed commentary and analysis of the graphite market.

Next key steps at Kambale

- Complete and report over coming months on the progress of tests designed and undertaken by specialist consultants ProGraphite, Germany, to confirm Kambale concentrate as a suitable base for the production of high-value Battery Anode Material (“BAM”);

- Commence and progressively report on the progress of a multi-disciplinary development Scoping Study; and

- Progress and report on ESG initiatives and independent benchmarking.