Beasley Creek Project

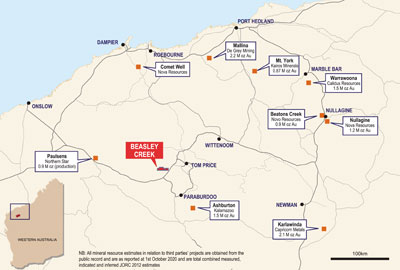

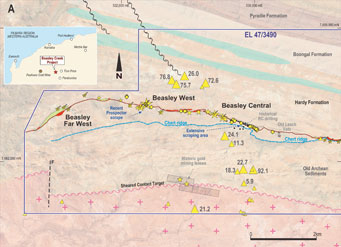

The Beasley Creek project lies on the northern flanks of the Rocklea Dome in the southern Pilbara. The strategy is to define structurally controlled gold targets within the older Archean sequences. These lie immediately below the 16km east-west striking conglomerate horizons which had been the primary focus of exploration by Castle. The sheared granite – greenstone contact and the “Paulsen Gold Mine” type setting within the gabbro/dolerite units, that intrude the Hardy Sandstone in the northern part of the project are, are of particular interest.

Within the tenement the unconformity contacts between the old Archean basement and overlying Mt Roe Basalt and Hardey Sandstone Formations have been mapped for 16 kilometres.

A specialist geochemical review of a 2020 stream sediment sampling program completed by Castle, defined four distinct zones of strong gold anomalism associated with these and a total of four different geological settings. has highlighted four high-priority gold and lithium anomalies for rapid field verification and drilling. Numerous other lower-order stream sediment and soil anomalies (total of 23), including for base metals, have also been delineated for follow-up.

Two of the priority gold targets fall within a structurally bound, northwest trending anomalous corridor in the centre of the licence. They comprise a consistently anomalous 600m zone with associated copper anomalism and a smaller anomalous gold zone with a multi-element association of silver, bismuth, nickel, platinum and palladium. Sample values peaked at 137ppb Au and 1010ppm Cu. A 2023 Castle soil sampling program targeting these two high priority targets has been completed and review of results is pending.

Lithium and the anomalous associated pathfinder elements also identified were not a specific target for exploration at Beasley Creek but their elevated values have provided Castle with an additional dimension to its exploration in the region.

Castle Minerals hold an 80% interest in the tenement with the balance held by Rosane Pty Ltd, an entity associated with prospector, Bob Creasy. Rosane is free carried to decision to a mine. Once Castle has advanced the project to a decision to mine, the vendor will be required to contribute pro-rata to all future expenditure or dilute according to standard industry terms.

In order to complete the transaction, Castle must make a final milestone payment comprising 2.0M Castle Performance Rights that will vest as and when Castle submits a Form 5 expenditure report of greater than $500,000 expenditure.

Castle undertakes to keep the licence in good standing at all times that it retains an interest.